SSA and VA for Veterans

Are you a veteran wondering about the difference between Social Security disability and VA benefits? Unsure how your VA disability benefit will impact your Social Security disability amount? Confused about the difference in criteria between your VA disability rating and Social Security disability? This article will discuss the differences between the two government-administered systems, the ways in which they interact, and how your VA disability rating can help speed up the long process of qualifying for Social Security disability.

How do Social Security disability and VA benefits compare?

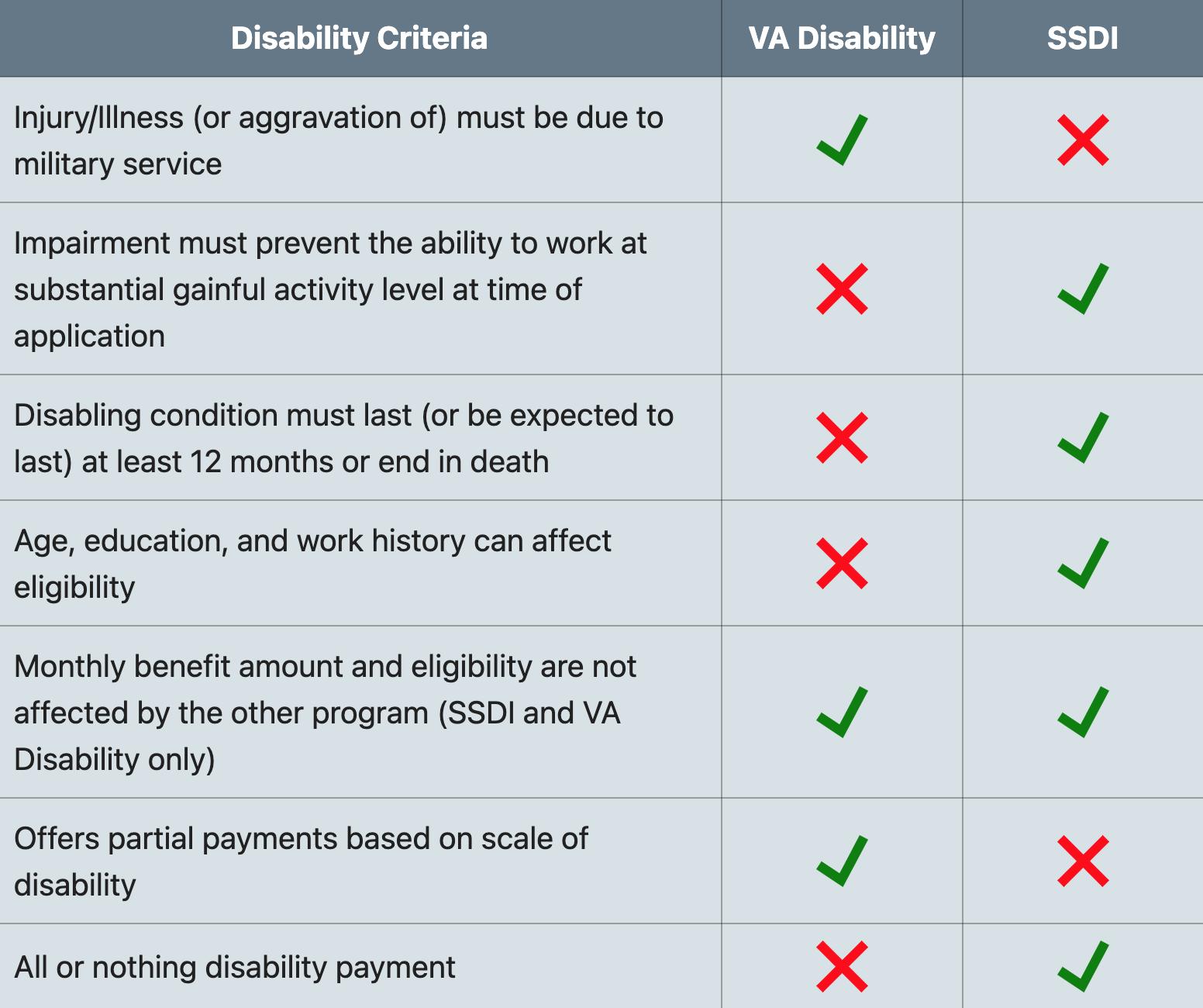

Like the Social Security Administration (SSA), the Department of Veterans Affairs (VA) is a federal government agency. The VA provides a benefit for veterans who are disabled by an injury that was incurred or aggravated during active military service. This is known as service-connected disability. VA service-connected disability benefits are paid on a scale from 10 to 100 percent depending on the severity of the disability. In addition to having a disability incurred or aggravated during active service, a veteran must also have a discharge status that is anything other than dishonorable.

Unlike the VA, Social Security does not rate the severity of a disability based on a percentage and does not consider the discharge status of a veteran. Also, Social Security does not consider whether your injuries are connected to military service. Instead, Social Security considers all impairments that would impact your ability to work, both physical and mental, so long as those impairments are long-term in nature (at least 12 months in duration).

Eligibility criteria

In order to be eligible for Social Security benefits, a veteran must have a condition that prevents substantial gainful employment. For the year 2022, Social Security considers any work grossing over $1,350 per month as substantial gainful income. In 2023, a gross income of $1,470 per month is the limit.

Unlike Social Security disability, a veteran receiving any other type of VA benefit besides Total Disability Based on Individual Unemployability (TDIU) can work and still receive service-connected VA compensation. If a veteran is currently working and applies for Social Security disability, the claim will likely be denied on the basis of the earned income. If you are a veteran considering a Social Security disability application, contact an attorney to discuss the timing of your claim. We typically recommend waiting at least six months after you stop working to apply for disability, although each case is unique and certain exceptions apply.

It is essential to understand that VA treatment records will be used by the Social Security Administration to make a decision regarding your eligibility for Social Security disability. For veterans living in the Bay Area, there are dedicated VA hospitals in San Francisco, Oakland, Livermore, Menlo Park, San Jose, and Palo Alto. Maintaining consistent treatment for the duration of a disability case is critical. If you receive treatment outside of the VA, make sure to list those treatment locations on your disability application. As discussed above, Social Security will consider all sources of medical evidence, including sources outside of the VA Hospital.

Benefits received

What makes veterans less and more likely to get these benefits?

How many veterans receive Social Security benefits too ?

In 2022, veterans accounted for 14.5 percent of all adult Social Security beneficiaries. In terms of dollar amounts, SSA provides statistics for male veterans ages 61 and under that show an average disability payment of $1,431, which is $182 dollars more than the average disability benefit for non-veteran males ages 61 and under. As you can see in the chart below, the SSA disability benefit is less than the VA benefit for a veteran who is rated 70 percent disabled and above.

What can veterans do to bolster their application?

Veterans in the United States are known as strong, silent, hard-working individuals who never complain. However, when it comes to seeking medical treatment for a disabling impairment, it’s critical to communicate openly and consistently with medical providers. This is good not only for mental and physical health, but it creates a detailed record when the SSA reviews a claim. The VA hospitals in the Bay Area keep meticulous electronic medical records containing the results of objective imaging studies such as MRIs and X-rays, observations and findings during in-person examinations, lists of medications and side effects, and summaries of treatment recommendations. Veterans should not suffer in silence or try to take on the SSA system without a good attorney in their corner.

Veterans who apply for Social Security disability should also list any medical providers outside of the VA hospital system. The SSA does not only consider treatment notes from the VA, but all medical sources received and requested. Because SSA places the burden of proof on the person applying for disability to establish disability, which is accomplished primarily through medical evidence, it is critical to list all sources of medical evidence.

In addition to maintaining consistent treatment and listing all medical sources on the application, veterans should make sure to submit their VA Rating Decision verification letter. This is especially important when the VA rating is for 100 percent permanent and total disability (100% P&T), which entitles a veteran to an expedited processing of the SSA claim.

If a veteran receives care from a family member through the VA Caregiver Program, the decision to award a caregiver by the VA should also be submitted to the SSA. The Caregiver Program will often assess weekly or monthly hours for basic activities of daily living such as picking up prescriptions, bathing, grooming, cooking and cleaning, and keeping track of and attending appointments. The VA Caregiver decision and allotted care hours are strong evidence that a veteran cannot perform full-time work according to Social Security regulations.

Finally, veterans should talk to their primary care provider and specialists (if applicable) regarding their Social Security disability claim. The doctor should complete an RFC (Residual Functional Capacity) assessment offering an opinion as to the workplace limitations imposed by the veteran’s impairments. In Social Security law, the agency is supposed to evaluate all medical opinions regarding disability. Supportability and consistency with the treatment record are the most important factors in this analysis.

A veteran improves their application by submitting an RFC from their treating physician, preferably a physician who has a long history of treating the veteran, and specializes in the area of the veteran’s disability (for example, a psychiatrist or psychologist for a veteran suffering from PTSD). We at LaPorte Law Firm have RFC forms that are tailored for SSDI, so contact us for a free copy.

Can veterans receive both VA disability and Social Security disability benefits?

Yes. A veteran receiving VA disability can receive Social Security disability without either benefit interfering or offsetting the other.

Veterans receiving partial VA disability rating and limited VA benefits are eligible for SSA benefits

Regardless of the VA disability rating, from 10 percent to 100 percent, an approval of Social Security disability does not offset the VA income. Similarly, the VA benefit, regardless of the amount, does not impact or offset the Social Security benefit.

Veterans with a 100% P&T disability rating are eligible for SSA benefits

Social Security regulations are explicit that the ratings from the VA are not binding on the Social Security Administration. Therefore, a VA rating of 100 percent permanent and total disability does not automatically qualify a veteran for Social Security disability. This is because the rules for qualifying for VA disability and SSA disability are distinct. The Ninth Circuit case McCartey v. Massanari held that, while not binding, an administrative law judge (ALJ) “must ordinarily give great weight to a VA determination of disability” and must give “persuasive, specific, valid reasons” supported by the record for giving a VA disability determination less weight. However, Social Security changed the evaluation of a “treating physician’s” opinion for claims filed after March 27, 2013, eliminating the so-called “treating physician rule” and the principle that the opinions submitted by treating physicians are entitled to “great weight”.

While the 2002 McCartey case has not been overturned by subsequent Ninth Circuit cases, in practice, ALJs are not compelled or required to give great weight or deference to a VA rating decision. The most important factor is the medical evidence underlying the VA rating. Still, a VA rating of 100% P&T disability is a strong indication that the medical records from the VA support a finding that the veteran cannot perform full-time work. Further, because the factors of “supportability” and “consistency” are still paramount, opinions regarding disability from treating physicians are still critical in Social Security cases.

How does the process look like

Social Security disability applications must be submitted through the Social Security website, in person at a Social Security office, or through the mail. An application for VA disability is separate and must be submitted through the VA.

For more information on the Social Security Disability Insurance (SSDI) application process, you can consult this page.

Can SSA benefits be denied?

Yes. In California, 62.8 percent of initial applications are denied at the initial level. On the first level of appeal, the request for reconsideration, 85.9 percent of Social Security disability claims are denied. At the administrative hearing level, hearing offices across the state have different approval rates. The San Francisco hearing office has an approval rate of 50 percent, the San Jose hearing office has an approval rate of 50 percent, and the Oakland hearing office has an approval rate of 46 percent.

Although a rating of 100% P&T disability from the VA is not a guarantee for Social Security disability approval, it does automatically entitle the veteran to an expedited processing of their Social Security case. Social Security maintains a list of priority cases that require field and hearing office staff to proceed expeditiously. Be sure to attach your VA rating verification letter along with your application to ensure a speedy processing of your case.

The case for Wounded Warriors

Veterans who sustained an injury on or after September 11, 2001, may be eligible for an expedited processing of the Social Security disability claim based on their Wounded Warrior status. Wounded Warriors are also on the list of Social Security priority cases. As with veterans with a 100 percent VA rating, Wounded Warriors should notify Social Security about their Wounded Warrior status when applying for Social Security disability.

Do SSA and VA benefits impact each other?

Does a VA benefit impact Social Security’s needs-based disability program? The answer is yes — when talking about supplemental security income (SSI).

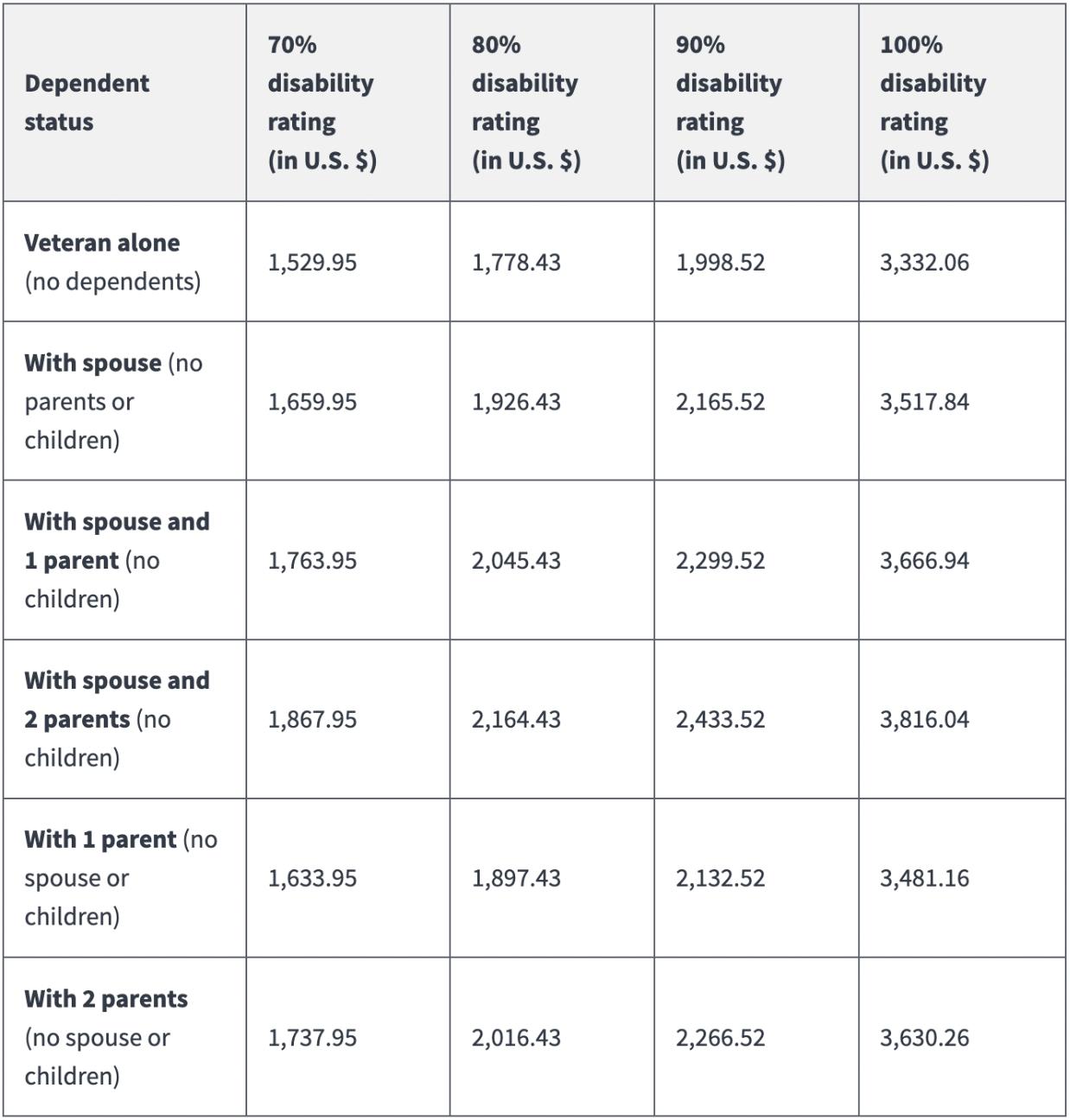

With SSI, Social Security conducts a resource test to make sure that the applicant meets the income requirements for the program. In general, SSI recipients must have less than $2,000 dollars in total assets if single, and less than $3,000 in total assets if married. Social Security treats the VA benefit as “unearned income.” Therefore, aside from a $20 exclusion, every dollar of the VA benefit counts toward the SSI asset limit. As you can see from the figures in the chart above regarding payment rates for veterans carrying a 100 percent VA rating, the VA benefit rises above the SSI asset test. Therefore, a veteran with 100% P&T disability will likely not qualify for SSI due to the stringent asset test.

It must be noted, however, that a VA benefit does not impact Social Security’s needs-based disability program when talking about social security disability insurance.

Social Security Disability Insurance, or SSDI, is funded through the veteran’s work history paying federal income taxes. SSDI does not mean-test applicants or beneficiaries. A single veteran carrying a VA rating of 100% P&T disability monthly amount of $3,332.06 can also receive 100 percent of their Social Security disability benefit without the VA benefit impacting the SSDI benefit. For example, a single veteran receiving $3,332.06 per month in VA benefits receiving the average SSDI benefit of $1,431 will receive a total combined monthly benefit of $4,763.06.

Seeking professional help to ensure you get the benefits

There are some misconceptions about the systems of the VA and the SSSA. If you are a veteran wondering whether the SSDI process is for you, call LaPorte Law Firm today to schedule a consultation at no cost to you. The consultation is confidential. We will discuss your work and medical history, and explain the Social Security process and how the regulations may apply to your specific case. Veterans who served this country deserve effective, responsive representation on their Social Security claim. We have extensive experience winning cases for veterans and helping veterans get the benefits they deserve as quickly as possible.

FAQs

Every disabled veteran has a unique Social Security benefit based on their work history. To find out your amount, create a “my SSA” account with Social Security.

The VA benefit amount depends on the number of dependents. The following chart is taken from the VA website:

The VA cannot revoke 100 percent permanent and total disability absent a showing by the VA that “actual employability is established by clear and convincing evidence” (38 CFR § 3.343(c)). If you have questions about appealing or filing a VA disability claim, consult with an attorney who specializes in VA law. Many private attorneys work on a contingency basis, and there are pro bono organizations in the Bay Area such as Swords to Plowshares that offer quality legal representation for veterans.

No. VA disability income does not count as “earned income” for SSDI. You can get your full VA benefit plus your full SSDI benefit.

Veterans can apply for SSDI through the Social Security website (recommended), or make an appointment by calling the SSA hotline at 1-800-772-1213, between 8:00 a.m. and 7:00 p.m. Those who are deaf or hard of hearing can call the toll-free “TTY” number, 1-800-325-0778, between 8:00 a.m. and 7:00 p.m., Monday through Friday.

Here’s a useful checklist from the SSA with the information required for a disability application. Veterans should also include a copy of the VA rating decision and the Compensation and Pension (C&P) examination along with their application.

You have 60 days (plus an additional 5 days) to appeal any unfavorable decisions. If you miss the deadline to file an appeal, you must submit a good cause statement for why you missed the deadline or start a new application. Call us right away if your application for Social Security is denied to discuss the next steps.