The Social Security Administration (SSA) is a federal agency that administers disability and retirement programs to millions of Americans every year. Currently, there are over 66 million people receiving benefits from the SSA.. If you are not receiving Social Security benefits, you likely know someone who does.

Those who cannot work due to a disability may be eligible for relief in the form of a monthly payment from Social Security. The disability program provides a critical lifeline to injured or disabled workers, bridging the gap between a worker’s disability onset date and their retirement years. For many disability beneficiaries, the monthly disability payment from Social Security is their primary form of income.

SSDI (Social Security Disability Insurance) is similar to an insurance system that workers “pay into” through their FICA-taxed earnings. When a worker becomes unable to work due to a disability, they can claim their disability benefit. If approved, a worker can collect monthly Social Security payments until their full retirement age, at which time the disability benefit converts to retirement. The monthly disability benefit is calculated based on their unique earnings record from work. The higher the amount of lifetime earnings, the higher the benefit amount.

Besides during Outside of a nine-month trial work period, disability beneficiaries cannot simultaneously earn substantial gainful income from working and collect their Social Security disability benefit. The Social Security disability benefit is intended for individuals who are unable to work due to a disability.

How does Social Security Know About Work Income?

While the Social Security disability benefit has specific rules and regulations regarding how much a beneficiary can earn from work income without losing the disability benefit, in practice, the Social Security Administration cannot track every dollar that millions of disability beneficiaries earn. The SSA relies on disability beneficiaries to report income from work and incentivizes this reporting through the trial work period rules, which are generally beneficial to disability beneficiaries once they are on the benefit.

However, not all disability beneficiaries are aware of the trial work period rules and mistakenly believe that they cannot work at all while on disability. Due to these mistaken beliefs, some disability beneficiaries attempt to hide income from Social Security, which leads to significant problems down the road.

This article will discuss how Social Security tracks earned income for disability beneficiaries, what happens when Social Security finds out about unreported income, and how to avoid the dreaded Notice of Overpayment for unreported income.

The Risks of Working on SSDI Without Reporting

-

Financial penalties

-

Legal consequences

Discontinued SSDI benefits

Working Legally on SSDI: Programs and Resources

If you are an SSDI beneficiary, you may be able to work and still receive your benefits. Here are some work programs and resources you can consider:

Trial work period (TWP)

Social Security allows for a trial work period for disability beneficiaries to test their ability to work. A disability beneficiary is a person who is approved for Social Security disability insurance benefits and is receiving their monthly disability benefit. Perhaps there is an improvement in their health or they are offered a job that accommodates their impairments. Due to this medical improvement or accommodated employment, a disability beneficiary tries to return to work and begins earning income. Because they report the new income to Social Security, they are enrolled in a TWP. They continue to work and earn income while simultaneously receiving their full Social Security disability benefit. The beneficiary can work and receive their disability benefit for up to nine months without losing their disability benefit. The nine months do not need to be consecutive.

At the end of the nine-month period, Social Security will examine the employment earnings to determine whether the work income was above the TWP limits. If so,the disability benefit will stop due to the performance of substantial gainful activity. If the work is under the applicable TWP amount, then your benefit will continue despite the receipt of earned income.

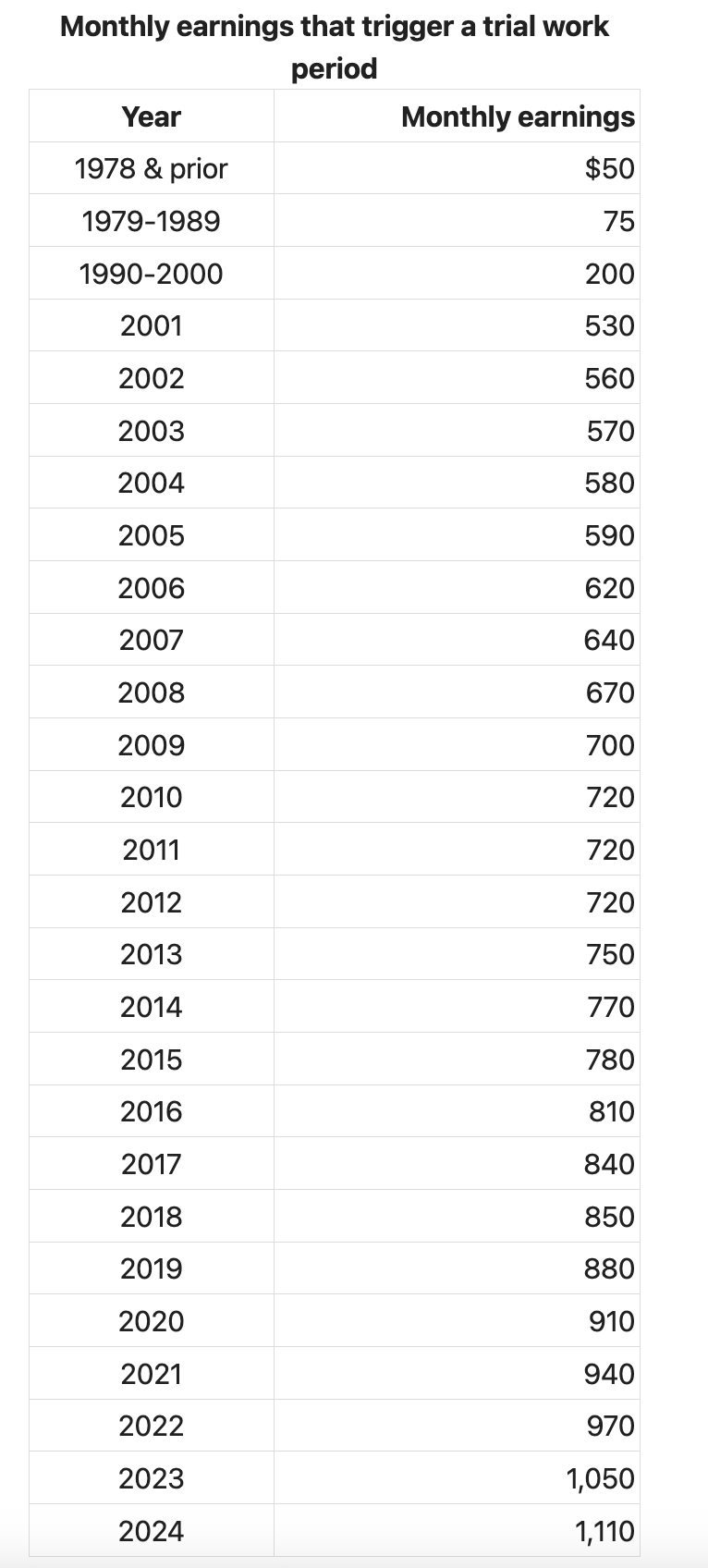

Certain income levels automatically trigger a trial work period. For example, in the year 2024, income exceeding $1,110 counts as one month toward a TWP month. Note that the below amounts are slightly less than the substantial gainful activity income limits, which apply to Social Security claimants who are not “beneficiaries” entitled to the trial work period.

Because the amount that counts toward a TWP month changes each year, you should refer to the Social Security website for updated TWP amounts. Once you start your trial work period, it continues until you have used nine months during a 60-month period.

Extended period of eligibility (EPE)

Once you complete your trial work period, you will enter into a 36-month period called the extended period of eligibility. After completing the trial work period, the Social Security Administration will determine if you are doing any substantial gainful activity. If you are working at a substantial gainful level, your SSDI benefits may end.

During the 36 consecutive months of the EPE, your SSDI eligibility is determined on a month-to-month basis. If you make over the substantial gainful activity amount, you will not receive your monthly benefit. If you don’t make over the substantial gainful activity amount in a particular month, you can still get your SSDI monthly benefit.

In 2024, substantial earnings refer to any income you earn that’s over $1,550. If you are entitled to an extended period of eligibility and earn less than $1,550, you can receive your disability benefit at the same time.

Ticket to Work program

If you would like to work, the Ticket to Work program may help you connect with employment services and benefits protection. The program also provides access to vocational rehabilitation and employment opportunities. If you are on the Ticket to Work program, your disability will not be reviewed. To learn more about the Program, visit the SSA website.

Alternative Options to Consider

You could also return to work through any of the options outlined below:

The SSA contracts with state vocational rehabilitation programs to pay for assistance to disability beneficiaries seeking services to return to work. Programs that help individuals with disabilities develop job skills and find employment. Individuals can receive training, counseling, and support to enhance their employability. The services must result in a beneficiary’s return to at least nine months of substantial gainful activity-level income.

Self-employment

For some disability beneficiaries, self-employment provides a good balance of flexible hours and freedom from the generally strict routine of an eight-hour per day, five-day per week job. The gig economy offers possibilities for disability beneficiaries to test their ability to work without the start-up costs of traditional self-employment. Companies such as Uber, Lyft, or Doordash allow self-employed contractors to use their vehicle as a means to earn self-employment income on their own schedule.

Social Security has a similar test for earnings for income earned by a self-employed disability beneficiary. Rather than the gross income tests discussed above for substantial gainful income and trial work period income, the SSA considers net income (earnings after business expenses) for self-employed disability beneficiaries. Therefore, in 2024, any month in which a self-employed disability beneficiary earns over $1,550 after deducting all of their expenses counts as substantial gainful employment. The trial work period limit is still $1,110 after deducting work and business expenses.

For example, consider a disability beneficiary who grosses $1,300 in one month driving Uber part time. However, due to $300 in expenses related to car insurance and gas, the beneficiary nets only $1,000 in income for the month. This month does not count as a TWP month because the net employment did not go over the $1,110 threshold for a TWP month.

While Social Security focuses primarily on the amount you earn when determining whether any given month counts toward your trial work period, note that months in which you work more than 80 hours toward your business can also count as a TWP month. Therefore, even if your business does not earn income, the hours you spend working on your business can still count as substantial employment, even if the work is not “gainful.”

Volunteer work

Volunteer work is a great way for disability beneficiaries to get out into the community. There are no rules against volunteering while receiving Social Security disability benefits. In general, you do not need to be housebound or bedridden to maintain disability eligibility. Disability beneficiaries lead normal lives and can be involved in their communities.

While Social Security does not have any specific rule or regulations pertaining to volunteering, you should be aware that the performance of volunteer work could be used as evidence of medical improvement on your continuing disability review, depending on how physically demanding the volunteer position is. Similarly, if you perform volunteer work that rises to the level of employment that would be normally compensated in the national economy, this could result in Social Security determining that the work is substantial enough to qualify as substantial gainful activity.

By learning and understanding Social Security’s rules for earning income while on the disability benefit, you can avail yourself of the trial work period incentives and avoid any issues with disability overpayments.

FAQs

You will be asked to repay any Social Security disability benefits that you are not entitled to. If you commit willful fraud, you may be subject to monetary penalties and even criminal felony prosecution resulting in imprisonment.

Yes, but only if you are found to have willfully lied to Social Security by withholding information about your work income. Honest mistakes or misunderstandings do not rise to the level of fraud. Fraud incidents rates are incredibly low, and actual prosecutions and convictions for disability fraud are near zero.

Contact a lawyer to discuss your rights if you are accused of Social Security fraud. In many cases, you avoid such accusations by responding in an honest and timely manner to requests for information from the SSA, and diligently correct any mistakes that occur on your Social Security record.

It is a good idea to consult an experienced disability attorney if you are facing issues with the Social Security Administration.

You have an ethical responsibility to report income from work to the Social Security Administration while you are receiving disability benefits. The purpose of the disability program is to provide a benefit for people who are unable to work due to a disability. Social Security provides a trial work period and extended period of eligibility for disability beneficiaries to test their ability to work, so it is in your interest to report all income from working.