If you are receiving SSI (Supplementary Security Income) benefits, it is important to know the income, resources, and spending rules. At LaPorte Law Firm, we help our clients win their SSI benefits and ensure that they remain compliant with best practices to maximize their monthly benefits.

The SSI program is a needs-based program. To remain eligible for SSI, your countable resources must be under a certain amount. This means if you have too much money or too many resources, you will no longer qualify for SSI benefits. The Social Security Administration (SSA) keeps track of your resources by looking at the “countable resources” of each SSI recipient. Countable resources are things that you own, like money, property, stocks, and bank accounts.

To stay eligible for SSI benefits, your countable resources must not exceed $2,000 if you are single or $3,000 if you are married. As a result, you must monitor what you purchase to ensure that the items you purchase do not increase your assets and resources past the countable resources limit. You also must monitor what money you save, as this could also result in savings that could pass the resource limit.

From basic personal needs to housing or entertainment, there are several categories of expenditures you can spend your SSI money on. The following paragraphs will go into details about each category.

The SSI benefit is a monthly benefits program that provides payments to children and adults with a disability with limited income and resources. If you are eligible for SSI benefits, the Social Security Administration has no rules that dictate how you spend your monthly benefit.

To be eligible for SSI benefits, you must have limited income and resources. Although you are allowed to spend your SSI benefit in any way you see fit, you might ensure that you follow all the income and resource rules.

Although there are no rules on what you have to spend your SSI benefits on, it is best practice to spend your SSI benefits to meet your basic personal needs first, before you spend money on any other expenses. This can include housing and utility costs, food, clothing, and personal care items.

In some cases, you may need help managing your SSI benefits. The Social Security Administration may decide that you need a representative payee because they have information that indicates that you need help managing your money. A representative payee is also required when a child beneficiary needs help managing their SSI benefits.

A representative payee is a person appointed by the Social Security Administration to help manage the monthly benefit payments for a person who is unable to do so on their own. The representative payee is typically a family member or friend of the SSI recipient needing assistance. But the Social Security Administration can also name an organization or an institution to act as the representative payee.

A payee will receive your monthly SSI benefits and help you spend that benefit. In order to act as the representative payee, the person or institution is bound by certain rules. These rules are in place to protect the disabled person receiving SSI benefits. The most important duty of a representative payee is to know your needs and use your SSI benefits in your best interests.

Your payee must use your SSI benefits for your current basic needs. These basic needs include food, clothing, housing, and medical care. Once your basic needs are met, the payee can use the rest of your monthly SSI benefit to pay your bills. If there is money left, the payee can save it.

The following lists the required duties of a payee:

Once your basic needs are met, it’s best if you next spend your money on safety, residential, and financial needs. You can use your SSI benefits to pay your rent or pay off any debts you owe.

After the representative payee helps you use your money to pay for your basic personal needs, the payee can use the rest of the money to do things like pay any past-due bills you may have. The representative payee can also play an important role in helping the SSI recipient to improve overall well-being. This can include advising recipients on budgets and making important financial decisions, negotiating with creditors and landlords, and helping the SSI recipient to understand their monthly benefits.

The law requires most minor children to have representative payees. As a representative payee for a minor child, you must first determine the child’s basic needs and use the SSI benefits to meet their needs. Once those basic needs are met, you must use benefits in the best interests of the child beneficiary, according to your best judgment. If there is money left over, this money can be spent paying for the child’s recreational activities.

Any funds that the payee does not need for the child’s needs must be saved. The representative payee has options for how to use and save funds in the child’s best interests. One option is to deposit the funds into an Achieving a Better Life Experience (ABLE) account. An ABLE account allows a payee to save funds for the disability-related expenses of the beneficiary. To qualify for an ABLE account, the disabled person must have become disabled by a condition that began prior to their 26th birthday.

An individual can spend their SSI monthly benefit in any way they see fit. But remember to spend this money wisely. It’s best to spend your SSI monthly benefit on basic necessities and paying off bills. If there is money left over, you may spend your monthly benefit on any other entertainment or activity of leisure. There’s no legal restriction on spending your SSI benefit on entertainment but such spending should be strategic.

There are several actions SSA can take to make sure you are still eligible for SSI at any given time. You should be aware of these important points and we will detail them in the following paragraphs.

To be eligible for SSI benefits , the Social Security Administration must review your financial information. As a beneficiary, you must give the SSA permission to contact any financial institution and review financial records. If you do not give the SSA this permission, you may not be eligible to receive SSI benefits. Hiding money from the Social Security Administration can result in federal charges. It is therefore important to provide all financial information to the SSA.

The Social Security Administration considers your income when deciding whether you are eligible for SSI payments. The more income you have, the less your SSI benefit will be. If your income is over the allowable limit, you will not receive your SSI benefits.

Any change in earnings needs to be reported to the Social Security Administration.

You can continue to work and remain eligible for SSI benefits. But if you receive SSI benefits and work, the income from work performed each month will be deducted from your monthly benefit. If you work while receiving SSI benefits, the Social Security Administration will disregard the first $65 you earn plus half of the remaining portion of your monthly earnings.

If you are working and engaging in substantial gainful activity, the Social Security Administration may determine that you are no longer disabled and will determine your benefits. Substantial gainful activity is a level of work activity that is measured by your earnings. In 2023, if you receive more than $1,470 a month in gross earnings, you are engaged in substantial gainful activity and the SSA may terminate your benefits.

If you start or stop work, you must report any gross income to the Social Security Administration. You must also report your duties, hours, and pay changes.

If your identity has been stolen, this can affect your finances. If you believe your identity has been stolen, you should contact the Social Security Administration immediately. The SSA will review your earnings to ensure your records are correct. You can contact the Social Security Administration at 1-800-772-1213.

Although some benefits from the Social Security Administration, including spousal benefits and SSDI benefits, are subject to taxation, SSI benefit payments are not taxable.

If you want to always stay on the right side of the law, it is recommended to follow certain guidelines and principles in your relation with SSA. Here are some advices on how to spend your SSI benefits wisely and always comply with the SSA rules.

The Social Security Administration has reporting requirements for recipients to remain eligible for the SSI benefit. Below is a list of the things that must be reported:

To avoid going over the income limit, it is important to continue to spend your SSI benefit on necessities. You are encouraged to spend money on your current needs, including housing and utilities, food, and clothing. It may also be helpful to continue to pay your bills to avoid going over the $2,000/$3,000 resource limits.

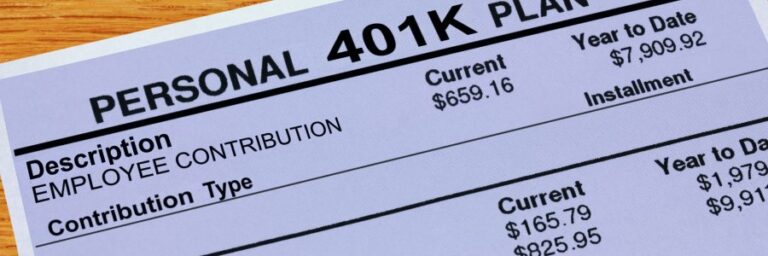

Once you win your SSI benefits, you may be owed back pay benefits. Back pay benefits are benefits that are owed to you back to the date of your application. SSI back pay benefits are paid in a lump sum or in installments, depending on how much the Social Security Administration owes you.

If you receive a lump sum payment from the Social Security Administration, you must spend down the benefits to continue to meet the income and resources eligibility requirements. The Social Security Administration will not count your lump sum benefit payment for up to nine months after you receive them, including payments received in installments.

When applying for and receiving SSI benefits, the Social Security Administration can monitor your bank account to track your balances to determine your income and assets. The SSA uses a verification program to access and review all alleged bank account balances with a financial institution. They may also conduct a geographic search for any other accounts that may belong to you. This monitoring is done to determine whether you meet the income and resource requirements of the SSI program.

The Social Security Administration can review your financial and banking information annually. Because the Social Security Administration has the right to check your bank account, it is important that you always avoid going over the $2,000/$3,000 resource limits.