It’s devastating to lose a loved one. If the deceased person was the primary earner in a family, the surviving spouse is often left wondering what types of benefit, if any, they may be eligible to receive. The Social Security Administration (SSA) recognizes the importance of providing benefits to the surviving spouse when a worker dies. Social Security survivors benefits are similar to a life insurance policy, in that the deceased worker paid into the benefit through their federal income taxes, and the benefit pays eligible surviving family members when the worker passes away.

It’s important to understand that the benefits discussed in this article are based on the work history of the deceased spouse. If a surviving spouse qualifies for a higher Social Security retirement or disability benefit based on their own work history, they will not receive survivor benefits. Social Security only pays the highest benefit that the surviving spouse is eligible to receive. A surviving spouse cannot claim multiple benefits simultaneously based on their deceased spouse and their own record.

Purpose of Providing Financial Support to Widows and Widowers

This benefit is especially important when the surviving spouse has never worked, and therefore never paid into the Social Security system through their own FICA taxes. For example, a surviving spouse may have raised the children of the deceased worker as the head of the household. In those cases, the surviving spouse has not paid enough “work credits” into Social Security benefits to be eligible for retirement or disability benefits under their own Social Security number. Even though the surviving spouse performed invaluable childcare labor, they may be in a financially precarious position when their working spouse passes away due to the lack of work history.

Types of Survivors Benefits (Retirement, Disability, Young Widows/Widowers)

There are different types of survivors benefits in the Social Security system, and it’s critical to distinguish between these to understand the options available.

- Widow(er)’s retirement benefits: A surviving widow or widower can receive Social Security benefits as early as age 60. They can also receive retirement benefits at any age if they are not remarried and take care of the deceased worker’s child, the child is under age 16, or the child is disabled and receives child’s benefits.

If the surviving spouse qualifies for retirement benefits based on their own work record, they can claim retirement as early as age 62, assuming their benefit is higher than their deceased spouse’s. - Disabled widow(er)’s benefits:A surviving widow or widower can claim this benefit if they are between age 50 and 60, and their disability began within 7 years of their spouse’s death.

If the widow or widower remarries after age 60 (or are eligible for disabled widow(er)’s benefits based on a disability that began after age 50), the marriage will not impact their surviving spousal benefits. - Surviving divorced spouse: A surviving divorced spouse can receive survivor’s benefits so long as the marriage to the deceased worker lasted at least 10 years. The payment of surviving divorced spousal benefits does not impact a surviving current spouse or other family member from claiming survivor’s benefits.

- Child’s benefits: The unmarried child of a worker who dies is under the age of 18, the child will also receive survivor’s benefits. They can also receive survivor’s benefits if they are between ages 18 and 19 and still in elementary or secondary school full time.

- Surviving parents: A surviving parent of a deceased worker may receive benefits if they are over age 62 and receive at least half of their support from the deceased worker when they passed away. This applies to natural, adoptive, and stepparents. In general, the surviving parent cannot marry after the deceased adult child’s death.

What Do I Do When My Spouse Dies?

Contact Social Security as soon as possible. It is important to note that you cannot apply for survivors benefits online. Call 1-800-772-1213 (TTY 1-800-325-0778) Monday through Friday, 8:00 a.m. to 7:00 p.m., or call your local Social Security office. In addition to the surviving family benefits, you can receive a one-time payment of $255 if you were living with the deceased.

Eligibility Criteria for Widow(er)'s Benefits

You must meet the following criteria in order to receive widow(er)’s benefits:

Must have been legally married to the deceased worker

In order to qualify for survivor’s benefits, one crucial qualification is that the widower must be a legal spouse, a putative spouse, or a deemed spouse of the deceased worker. Here is house Social Security determines whether you are a spouse for the purposes of survivors benefits:

- Legal spouse: This is the most straightforward. A legal spouse has a valid marriage under the laws of the state in which the deceased was living at the time of death. For example, a legal spouse has an original or certified copy of the public marriage certificate or religious record of marriage.

- Putative spouse: This occurs in instances where the marriage is void due to a defect, such as a prior undissolved marriage of the deceased spouse of which the surviving spouse was previously unaware. In some states, spouses from a void marriage have the same rights as a surviving spouse. In California, a putative marriage can be established based on an invalid ceremonial marriage only in one limited circumstance: the surviving spouse was unaware of the laws and customs of the state, they were unable to ascertain the legal requirements of a valid marriage in the state of California due to an inability to read or speak English, and had reason to believe that the marriage license alone was sufficient to establish the marriage.

- Deemed spouse: The surviving spouse of a deceased worker went through a valid marriage ceremony in good faith, however the marriage was invalid due to a legal impediment. Examples of legal impediments include a prior marriage that was not dissolved, the attempt to dissolve the marriage was not valid, the marriage was dissolved but there was a restriction against remarriage, and the marriage is not valid due to a procedural defect in the state the marriage occurred.

- A deemed marriage occurs when the deceased worker and surviving spouse went through a marriage ceremony, the surviving spouse went through the ceremony with the good faith belief that there were no legal impediments to the marriage, the surviving spouse was living in the same home as the deceased worker (except for surviving divorced spouses), and the legal impediment arises out of a lack of dissolution of the previous marriage.

Duration of marriage

Another critical requirement for the surviving spouse is that the marriage must have lasted at least nine months prior to the day of the deceased worker’s death. A surviving divorced spouse must have been married to the deceased worker for 10 years.

Age requirements

Widow(er)’s full retirement age vs. early eligibility age

It’s important to note that, when a surviving spouse claims widow’s benefits at age 60, they are doing so at a reduced rate. An eligible surviving spouse can claim widow(er)’s benefits at any age between 60 and 70 years of age. If a surviving widow claims the benefit early, the monthly payment amount is reduced by a fraction of a percent for every month before their full retirement age. (Note: If the surviving spouse qualifies for a higher retirement benefit based on their own record, they can switch to the higher benefit as early as age 62 and as late as age 70.) To find out your full retirement age, use this calculator from the Social Security website.

Work history of deceased spouse

Deceased spouse must have earned enough work credits

In order to be eligible for survivors benefits, the deceased spouse must have worked long enough and paid into Social Security. The Social Security Administration cannot pay benefits unless the deceased worker has at least 40 quarters of work history in a job that paid FICA taxes. A worker can earn four quarters of Social Security coverage per year. In 2023, the amount of income needed for one year is $1,640. These credits earned stay on the worker’s Social Security record regardless of a job transfer or work stoppage. In general, a worker needs 10 years of earnings to be fully insured for a Social Security benefit.

Disability considerations

Eligibility for widow(er)’s disability benefits

A disabled widow or widower must prove disability under the same criteria as a regular application for disability. In addition, a disabled widow or widower must be between the ages of 50 and 60, and become disabled within 7 years of the deceased spouse’s date of death.

In addition to the age criteria (age 50–60) and the requirement that the disability begin within 7 years of the date of the spouse’s death (the prescribed period), a disabled widow must prove disability under the Social Security Administration’s five-step sequential evaluation.

The SSA applies a five-step evaluation to every claim for adult disability. This five-step evaluation applies regardless of the disability being alleged or the type of adult benefit applied for (disabled widow(er)’s benefits, SSI disability, or SSDI). The following five questions will apply to a disabled widow(er)’s benefit application:

- Step 1: Are you working? If so, the SSA issues an initial step 1 denial. The severity of the alleged disability will not be considered. If you are not working, the SSA proceeds to step 2.

- Step 2: Is your condition severe? A severe condition impacts your ability to perform basic work-related activities for at least 12 months.

- Step 3: Does your condition meet the requirements of Listed Impairments? In general, a listing level impairment is a high bar to clear since the medical criteria usually require strict objective medical findings in the treatment evidence. If the SSA finds that you meet one of the medical listings, your case is approved automatically. If not, the case proceeds to step 4.

- Step 4: Can you return to your past work? Past relevant work is any job you’ve performed in the past 15 years. If you can return to your past work, a claim for disability is denied at step 4. If not, the claim proceeds to step 5.

- Step 5: Can you do any other type of work in the national economy? The burden of proof shifts to the government to prove there is other work in the national economy that a disabled widow or widower can perform.

Applying for Widow(er)'s Benefits

An application for widow(er)’s benefits cannot be filed online. You should call Social Security as soon as possible at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday between 8:00 a.m. and 7:00 p.m. local time to report a spouse’s death and apply for survivor’s benefits. Or, contact your local Social Security office. In many cases, the funeral home will report the death to Social Security, so you can also give the funeral home the deceased person’s Social Security number.

Required application documents

You should be prepared to provide the following information to Social Security on an application for survivors benefits:

- Proof of death, either from a funeral home or death certificate.

- Your SSN and the deceased worker’s SSN

- Your birth certificate

- Your marriage certificate if you’re a widow or widower

- Your divorce papers if you’re applying as a divorced widow or widower

- Dependent children’s SSNs, if available, and birth certificates

- Deceased worker’s W-2 forms or federal self-employment tax return for the most recent year

- The name of your bank and your account number so your benefits can be deposited directly into your account

If you don’t have all of the information listed above, don’t delay with the application. Social Security can assist with obtaining some of the information above, and it’s important to note that the benefits start from the month of the application.

Appeal process

If you disagree with a decision made on your case, you have a right to file an appeal. The first appeal is called a request for reconsideration (SSA-561). If the request for reconsideration is denied, you have the right to request a hearing before an administrative law judge (ALJ) using form HA-501. If the case is denied by the ALJ, you have a right to file an appeal with the Appeals Council using form HA-520.

Claiming considerations

Choosing when to take reduced early benefits vs. full benefits

Each situation is unique and involves multiple factors and financial considerations. If you are considering filing for early survivors benefits (or early retirement benefits based on your own work record), consult a trusted financial advisor first before filing your application.

Amount and Duration of Survivor Benefits

You can calculate the benefit amount based on your deceased spouse’s earnings history. You can submit a request to Social Security for the earnings record of your deceased spouse using form SSA-711. In general, survivors receive the following percentages of a deceased worker’s full benefit amount:

- Widow or widower, at full retirement age or older, generally gets 100% of the deceased worker’s basic benefit amount

- Widow or widower, age 60 or older, but under full retirement age, gets between 71% and 99% of the deceased worker’s basic benefit amount

- Widow or widower, any age, with a child younger than age 16, gets 75% of the deceased worker’s benefit amount

- Child gets 75% of the deceased worker’s benefit amount

When a fully insured worker passes away, the surviving spouse and surviving children may each be eligible for survivors benefit. In cases where multiple family members are eligible for survivors benefit based on the same work record, the maximum family benefit rules may apply. The SSA uses a complex formula for determining the maximum family benefits to a deceased worker’s surviving family. The formula ultimately yields a maximum family benefit that is between 150% and 188% of the deceased worker’s full benefit amount.

Factors Impacting Benefit Amount

The following factors can impact the benefit amount for survivorship beneficiaries:

- Age when claiming benefits: If claimed at age 60, the surviving spouse will receive a lower monthly amount compared to claiming the benefit at age 70.

- Timing and length of marriage: If a surviving divorced spouse was married to the deceased worker for at least 10 years, they are eligible for survivors benefits after age 60, or between 50 and 60 if disabled. The surviving divorced spouse, however, does not need to have a marriage that lasted 10 years if they are taking care of the deceased worker’s child under age 16, or if the child is disabled.

- The lifetime average earnings of the deceased spouse: This is the biggest factor in calculating the survivorship benefit. The more income a deceased spouse earned over their lifetime of work, the higher the survivorship benefit amount.

Ongoing Eligibility Factors

Here are other factors that affect your eligibility for widow(er)’s benefits:

- Benefits continue until remarriage or death: If you remarry before age 60, or age 50 if disabled, you cannot continue to receive survivors benefits. If the remarriage occurs after age 60, the survivors benefits will not be impacted and can continue.

- Benefits if taking care of minor children: You are eligible for survivors benefits at any age if you take care of the deceased worker’s minor child under age 16, or if the child is disabled and receiving child’s benefits, regardless of your age.

Taxation and Coordination of Survivor Benefits

Many survivorship beneficiaries wonder if their benefit is taxable. The taxability of the survivorship benefit depends on the income of the surviving spouse.

Taxes on Survivor Benefits

If the surviving spouse’s gross income and survivorship benefit add up to greater than $25,000 in the year 2023, a portion of their benefit may be taxable. If the gross income and survivors benefit is between $25,000 and $34,000, up to 50% of the survivors benefit may be taxed (at the applicable rate). If the income exceeds $34,000, up to 85% of the benefit may be taxed at the applicable rate.

Most states, including California, do not tax survivors benefits. Every situation is unique and you should always consult a tax professional to understand whether your benefit is subject to taxation.

Impacts of Working While Receiving Benefits

If you receive early SSA survivors benefits, your income may impact your benefit. After you reach full retirement age, there is no limit to how much you can earn, and your earnings will not impact your benefit. It’s important to note that work will only impact the benefit of the working survivor, not the benefits of other surviving family members.

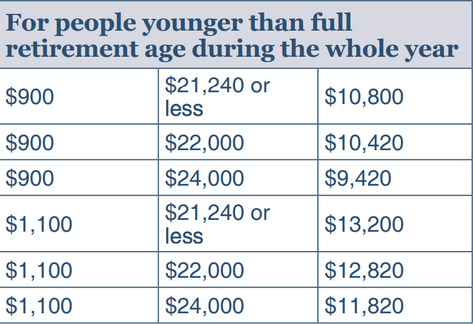

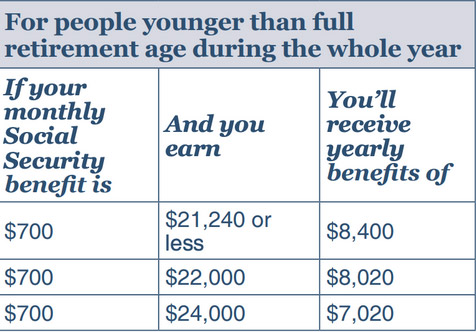

If you were born after January 1, 1960, your full retirement age is 67. If you work in 2023 and are younger than full retirement age, the SSA will deduct $1 for every $2 you earn above $21,240 for the year. If you reach full retirement age in the year 2023, the SSA will reduce $1 dollar for every $3 you earn above $56,520.

FAQs

Income from work may reduce your survivorship benefits, depending on how old you are. If you are between the ages of 60 and your full retirement age (age 66 for those born between 1945 and 1956, and age 67 for those born 1962 or later). If you work and earn income greater than $21,240 in the year 2023, your survivors benefit will be reduced by $1 dollar for every $2 earned over $21,240.

A widower of a deceased worker and the surviving divorced ex-spouse can both claim survivors benefits without impacting each other. A divorced former spouse can claim the survivorship benefit without impacting the benefit amount of the surviving widowed spouse. Both surviving spouses can receive up to 100% of the deceased worker’s benefit, assuming they claim the benefit when they reach their full retirement age.

You have a right to file an appeal. Don’t delay, because you have only 60 days to appeal any unfavorable decision from the Social Security Administration.

Yes. Unmarried children under the age 18 (or ages 18–19 if still in high school) can get benefits based on your earnings record. Your children can also get benefits if they have a disability that began prior to age 22.