For millions of Americans, Social Security is a cornerstone of financial stability in retirement. These earned benefits provide a crucial income stream, but their real-world value can be eroded by the rising cost of living. As the cost of basics such as groceries and gas inflates, especially in high-cost-of-living areas such as the Bay Area, the value of the fixed Social Security benefits goes down. Therefore, the annual Cost-of-Living Adjustment (COLA) can provide some relief from inflation. After a short delay caused by the late release of official inflation data, the Social Security Administration announced a 2.8% Cost-of-Living Adjustment (COLA) for 2026 on October 24, 2025, taking effect in January 2026. This adjustment reflects the latest inflation data and will provide a modest but meaningful boost to monthly benefits. This article provides a comprehensive update on the latest COLA release, delves into how this adjustment is calculated, and explores what it ultimately means for your monthly benefits and long-term financial health. Understanding these dynamics is the first step toward navigating your retirement with confidence in a constantly changing economy.

Navigating Your Social Security Benefits in a Changing Economy

The Crucial Role of the Cost-of-Living Adjustment (COLA)

The Social Security Cost-of-Living Adjustment is an automatic annual increase in benefits designed to counteract the effects of inflation. Without it, the purchasing power of a retiree or disability beneficiary’s fixed income would steadily decline over time. A monthly benefit that seems adequate at the start of retirement could become insufficient to cover basic necessities like housing, healthcare, and food a decade later. The COLA ensures that the value of Social Security benefits remains relatively stable, protecting the financial security of beneficiaries. This adjustment applies not only to retirement benefits but also to disability and survivor benefits, as well as Supplemental Security Income (SSI), making it a fundamental pillar of America’s social safety net.

Understanding How Your Social Security COLA is Calculated

The annual COLA isn’t an arbitrary figure; it’s the result of a specific formula tied directly to inflation data. However, the method used by the Social Security Administration (SSA) has been a subject of ongoing debate, with many arguing that it doesn’t fully capture the real expenses faced by seniors.

The Mechanics of the Cost-of-Living Adjustment

The Social Security Act mandates that COLAs be based on increases in the Consumer Price Index for Urban Wage Earners and Clerical Workers, commonly known as the CPI-W. This index is compiled and published by the federal government’s Bureau of Labor Statistics (BLS). The CPI-W tracks the average change over time in the prices paid by a specific demographic for a basket of consumer goods and services.

The calculation process is precise. The SSA compares the average CPI-W for the third quarter of the current year (July, August, and September) with the average CPI-W from the third quarter of the last year a COLA was determined. The percentage increase between these two averages becomes the COLA for the following year. For example, to determine the COLA that takes effect in January, the SSA would analyze the inflation data from the summer months of the preceding year. If there is no increase, or if the average decreases, there is no COLA, but benefits do not decrease. This direct link to inflation data makes the third-quarter economic reports essential news for every retiree.

The CPI-E Debate: Why Many Argue for a Better Measure for Seniors

A significant and persistent criticism of the current COLA calculation is its reliance on the CPI-W. This index reflects the spending habits of working-age urban households, which can differ substantially from the spending patterns of retirees. Seniors and advocates argue that this metric underweights the categories where older Americans spend a larger portion of their income—most notably, healthcare and housing.

Medical costs, including Medicare premiums, deductibles, and out-of-pocket prescription drug expenses, typically rise faster than overall inflation and consume a disproportionate share of a retiree’s budget. The CPI-W, focused on a younger demographic, doesn’t fully capture this impact.

In response to this concern, the Bureau of Labor Statistics developed an experimental index called the Consumer Price Index for the Elderly (CPI-E). The CPI-E is specifically designed to reflect the costs incurred by households with individuals aged 62 and older. Historically, the CPI-E has tended to rise slightly faster than the CPI-W, suggesting that if it were used for the calculation, Social Security COLAs would have been marginally higher over the years. Proponents believe adopting the CPI-E would provide a more accurate and equitable adjustment for beneficiaries, better protecting their purchasing power against the expenses they genuinely face. However, switching to this index would require an act of Congress and would have significant financial implications for the Social Security trust funds.

The Official 2026 COLA: What It Means for Your Benefits

So what does this mean for your Social Security benefit? Generally, retired workers’ Social Security checks will increase by $54, from $2,008 to $2,062, effective on January 1, 2026.

Historical Context: How Current Predictions Compare

The COLA adjustment for 2026 is .3% higher than the adjustment for 2025. The 8.7% COLA for 2023 was the largest in four decades, a direct response to soaring post-pandemic inflation.

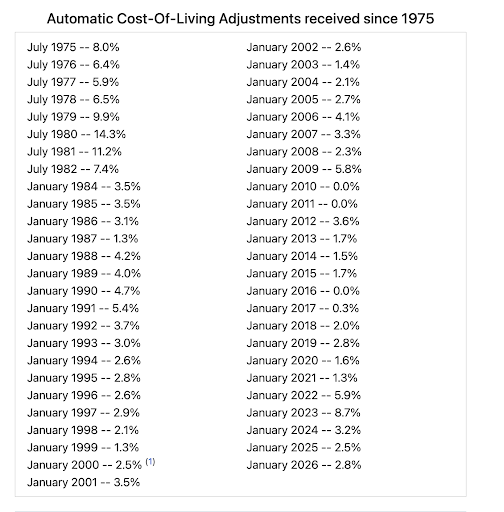

The long-term average COLA over the past two decades has hovered around 2.6%. The 2.8% COLA for 2026 aligns closely with the historical norm, indicating that the post-pandemic inflation surge has largely subsided and the economy has returned to more typical inflation patterns. For reference, here are all the COLA adjustments since 1975

What the Predicted COLA Means for Your Monthly Benefits and Beyond

A percentage is just a number until it’s translated into dollars and cents. Understanding the tangible impact of the predicted COLA on your monthly check—and how other factors can affect that amount—is essential for effective budgeting and financial management.

Direct Impact on Your Social Security Checks

For 2026, a 2.8% COLA means that a retiree receiving the average monthly benefit of around $1,915 will see an increase of about $54 per month starting in January 2026.

The most straightforward effect of the COLA is the increase in your gross monthly benefit. To calculate your personal increase, you can convert the COLA percentage to a decimal and multiply it by your current benefit amount. For example, if the COLA is 3.0% (or 0.03) and your current monthly benefit is $1,800, your increase would be $54 ($1,800 x 0.03), bringing your new monthly benefit to $1,854.

The Social Security Administration typically releases figures on the average increase for different types of beneficiaries. Your personal increase will depend entirely on your unique benefit amount. Those with higher benefits will see a larger dollar increase, while those with lower benefits will see a smaller one. This direct boost to monthly income is the primary way the COLA helps beneficiaries manage rising costs.

The Real-World Test: COLA vs. Actual Cost of Living

While the COLA provides a welcome increase, many retirees find that it doesn’t always fully cover their rising expenses. This gap is often due to two key factors: the limitations of the CPI-W and the rising cost of Medicare. As previously discussed, the CPI-W may not adequately reflect seniors’ spending on healthcare.

Furthermore, a significant portion of the COLA can be consumed by increases in Medicare Part B premiums, which are often deducted directly from Social Security benefits. If the Part B premium increases substantially in a given year, it can significantly reduce, or in some cases, entirely wipe out the net gain from the COLA. The “hold harmless” provision protects most beneficiaries from having their Social Security check decrease due to a Medicare premium hike, but it doesn’t prevent the premium increase from eating into the COLA. Therefore, the “real” value of the COLA is the amount left over after accounting for these unavoidable medical expenses.

Actionable Steps for Social Security Beneficiaries

According to the Social Security website, COLA notices for beneficiaries will be available in “late November”. If you are a Social Security beneficiary, you should create a My SSA Account and check for your COLA statement.

FAQs

The 2026 COLA was announced on October 24, 2025, about a week later than the typical mid-October release. The delay was caused by a short postponement in the Bureau of Labor Statistics (BLS) release of September inflation data, which the Social Security Administration (SSA) needs to calculate the final COLA figure.

The Social Security Administration (SSA) confirmed a 2.8% Cost-of-Living Adjustment for 2026. The new benefit rates take effect in January 2026 and will apply to retirement, disability, and survivor benefits, as well as Supplemental Security Income (SSI).

The SSA bases the annual COLA on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). It compares the average CPI-W for the third quarter (July–September) of the current year with the same period of the last year a COLA was determined. The percentage increase becomes the new COLA.

For 2026, a retiree receiving the average monthly Social Security benefit of about $1,915 will see an increase of roughly $54 per month. The exact amount varies depending on individual benefit levels.

A 2.8% adjustment suggests that inflation has moderated compared to the sharp spikes seen in 2022 and 2023. It reflects a return to more typical inflation levels while still accounting for ongoing increases in essentials like housing, food, and healthcare.