To be eligible for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) benefits, you must meet certain nonmedical requirements established by the Social Security Administration (SSA). In this article, we will explain the nonmedical requirements for each of these programs to ensure that you are eligible for disability benefits.

What Are Non-Medical Requirements for SSDI?

The nonmedical requirements for SSDI include factors such as income, resources, and work history, all of which play a crucial role in determining your qualification for this vital financial support program.

Insurance status

To qualify for SSDI benefits, you must be insured for the Social Security program. SSDI benefits are similar to an insurance system that workers pay into via the Social Security FICA tax. To qualify for SSDI, you must have earned enough work credits to be “insured” for the program. These credits are accumulated through the payroll taxes you pay while working. You can confirm that you’ve paid Social Security taxes by looking at your W-2 statement or 1099 pay stubs.

If you have not paid enough FICA taxes to be insured for SSDI, you are not eligible for SSDI benefits. To be insured, you must have at least 20 work credits during the past 40 quarters (10 years). You can earn four work credits per year.

If you are age 31 or older, you must have worked and earned 20 work credits to be eligible for SSDI benefits. If you are younger than 31 years old, the number of work credits you need to be eligible for SSDI benefits is reduced. Generally, work credits earned before age 21 do not count. However, if you become disabled before age 24, you must have six work credits within the last 12 quarters (three years) to be eligible for SSDI benefits.

The following chart outlines the number of credits you must earn to be eligible for SSDI benefits:

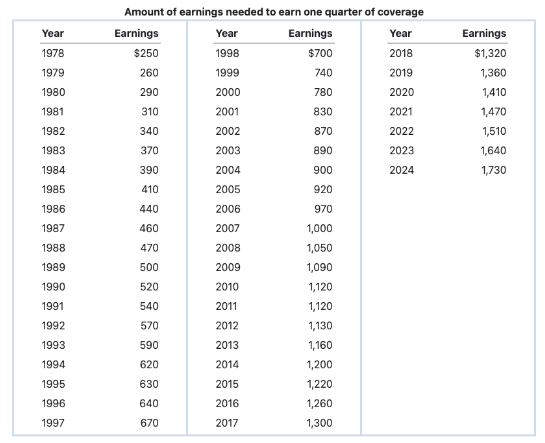

To earn a work credit in 2024, the amount of income needed for one quarter is $1,730. Historically, here is the amount of earnings you need to earn one quarter of coverage:

Recent work test

You must have worked recently enough before your disability began to be eligible for SSDI benefits. Generally, under the recent work test, you must have worked in 5 of the prior 10 years (20 credits in the least 10 years) before becoming disabled. This rule applies to those who are at least 31 years old. The rules are different for younger individuals:

- Before age 24 – You may be eligible for benefits if you have earned six credits in the three-year period before your disability began.

- Age 24–31 – In general, you may be eligible if you have credit for working half the time between age 21 and the time your disability began. For example, if you develop a disability at age 27, you would need three years of work (12 credits) out of the past six years.

Citizenship or legal residency

You must be a US citizen or a US national or lawfully present in the United States to apply for SSDI benefits. If you are a US citizen, you can be eligible for and receive SSDI benefits if you live outside of the United States. If you are not a US citizen, you need to be present in the United States to receive your SSDI benefits.

Disability started before retirement age

The onset of your disability must have occurred before reaching full retirement age. To find out your full retirement age, use the SSA’s Retirement Age Calculator. SSDI benefits automatically convert to retirement benefits when you reach full retirement age.

If you are collecting early retirement from the SSA, you can still apply for SSDI benefits. If you take early retirement and are later approved for SSDI, the SSA will reimburse the difference and pay you your SSDI benefit.

What Are the Nonmedical Requirements for SSI?

SSI is a needs-based program. You do not have to have paid into the Social Security system or be insured to be eligible for SSI benefits. You may be eligible for SSI benefits if you meet SSA’s nonmedical requirements, which include the following:

You have little or no income

SSI is available to individuals who do not receive more than $1,971 in income each month. The income limit increases for couples and when parents apply for children. The SSA will look at all sources of income including wages, other disability benefits, unemployment, and pensions in determing your eligibility for SSI.

You have little or no resources

To receive SSI benefits, your resources cannot be more than $2,000 for individuals or $3,000 for couples. Resources are the things you own that count toward the resource limit. Common resources are cash, personal property, stocks, and vehicles. There are resources that do not count against this limit. These include the home you live in and the land it is on and one vehicle that you use for transportation. To get a full list of resources and exceptions, click here.

You are a citizen or meet certain classifications

To be eligible for SSI, you must be a US citizen or must be in one of the following classifications granted by the Department of Homeland Security:

- Lawfully admitted for permanent residence

- Granted conditional entry

- Paroled into the United States

- Admitted as a refugee

- Granted asylum

- An alien whose removal is being withheld

- A Cuban or Haitian entrant

- Admitted as an Amerasian immigrant

- Admitted as an Afghan or Iraqi Special Immigrant

- Admitted as an Afghan humanitarian parolee or Afghan Non-Special Immigrant parolee

- Admitted as a Ukrainian humanitarian parolee

FAQs

To be eligible for SSI benefits, you must have limited assets and income. Your total assets and income must not be worth more than $2,000 for an individual or $3,000 for a couple. On the other hand, there is no income limit to be eligible for SSDI benefits. You can continue to receive passive income and remain eligible for benefits.

To be eligible for SSDI benefits, you must have a sufficient work history to be insured. To be fully insured, you must have earned at least 20 work credits during the last 40 quarters (10 years) prior to the start of your disability.

Age plays a role in the nonmedical requirements for benefits. For SSDI benefits, you can only receive benefits until you are no longer disabled or you reach full retirement age. At full retirement age, your disability benefits will end, and you will receive your retirement benefit. To learn more about the impact of age on the disability standard, see our blog article on The Factor of Age In Social Security Disability Evaluation.