As Medicare costs change each year, disability beneficiaries who qualify through Social Security Disability Insurance (SSDI) need clear information about what those changes mean for their health coverage costs in 2026. The Centers for Medicare & Medicaid Services (CMS) released updated premiums, deductibles, and income-related adjustments for Medicare Part A and Part B that will apply in 2026. This article breaks down the key changes and what SSDI beneficiaries should expect.

New Medicare Part B Premiums in 2026

For most SSDI beneficiaries, the Part B monthly premium is the most visible Medicare cost because it is usually deducted directly from Social Security benefit checks.

Here are the Medicare premiums for the year 2026:

- 2026 standard Medicare Part B premium: $202.90 per month – This is up $17.90 from the $185.00 standard premium in 2025.

- 2026 Part B annual deductible: $283 per month – This is up $26 from the $257 deductible in 2025.

These increases reflect broader trends in healthcare utilization and cost projections used by CMS each year. The Part B premium covers physician services, outpatient care, preventive services, and medical supplies.

Even with the increase, many beneficiaries may find that Social Security cost-of-living adjustments (COLA) help offset these higher costs, although premiums still represent a significant portion of monthly expenses.

Read also: 2026 Social Security Cost of Living (COLA) Adjustment Update

What Disability Beneficiaries Pay for Medicare Part A?

Medicare Part A generally covers hospital care, skilled nursing facility stays, hospice, and some home health services.

- Most SSDI beneficiaries pay no Part A premium because they have enough work history (40 quarters of Medicare-covered employment).

- If someone does not have enough work credits, they may purchase Part A coverage in 2026 at:

- $311 per month (reduced rate if you had 30–39 quarters of coverage)

- $565 per month (full premium for those with fewer than 30 quarters)

For beneficiaries who do pay Part A premiums, these amounts have increased from 2025.

Income-Related Monthly Adjustment Amounts

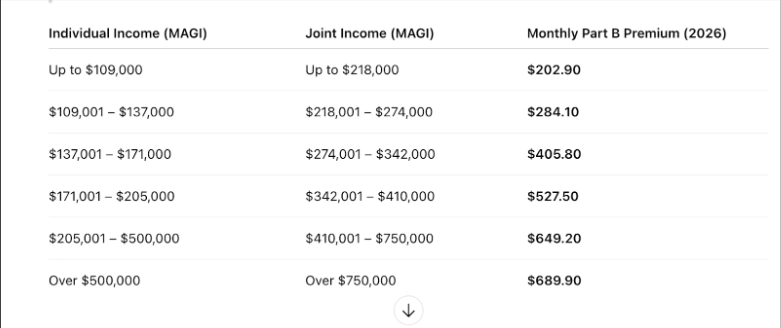

Some SSDI beneficiaries may pay higher Part B premiums based on their income. These income-related monthly adjustment amounts (IRMAA) apply if your modified adjusted gross income (MAGI) from two years earlier exceeds certain thresholds.

For 2026 Part B coverage, MAGI levels and total monthly premiums include:

These amounts reflect the IRMAA scale designed to have higher-income beneficiaries pay more toward their Medicare costs.

What This Means for SSDI Beneficiaries

If you receive Medicare due to disability, your Part B premium is typically automatically deducted from your Social Security benefit each month. Medicare eligibility begins 24 months after SSDI entitlement. For many beneficiaries with lower income levels, the standard premium ($202.90 in 2026) will apply, but if your income is above the IRMAA thresholds, you may pay more.

Many SSDI beneficiaries are also protected by provisions such as hold harmless rules. These rules may prevent your overall Social Security benefit from dropping solely because of higher Medicare deductions, particularly if your benefit increase (COLA) is equal to or greater than the Part B increase.

Strategies to Manage Costs

While Original Medicare does not cap annual out-of-pocket spending, SSDI beneficiaries have options to manage costs:

- Medicare Savings Programs may help pay Part B premiums for low-income beneficiaries.

- The Extra Help (Low-Income Subsidy) program can reduce Part D prescription drug costs.

- Choosing a Medicare Advantage plan could offer additional benefits or lower cost sharing.

It’s also a good idea to review your Medicare coverage during the annual Open Enrollment Period (October 15–December 7, 2026) to ensure your plan options align with your healthcare needs and budget.

Final Takeaway

For 2026, CMS has announced that Medicare Part B premiums and deductibles will rise, with the standard Part B premium increasing to $202.90 and the annual deductible rising to $283. High-income beneficiaries may see substantially higher premiums due to IRMAA. SSDI beneficiaries should be prepared for these changes and explore cost-saving options where available to manage their healthcare expenses effectively.

The 2026 Medicare Part B premium updates may change how much SSDI recipients take home each month. Knowing what to expect can make all the difference. LaPorte Law Firm provides personalized guidance to help you stay informed and prepared. Contact us today to discuss your options and plan ahead with confidence.

FAQs

The standard Medicare Part B premium in 2026 is $202.90 per month. Most SSDI beneficiaries pay this amount unless they qualify for income-based adjustments or assistance programs.

Most SSDI beneficiaries do not pay a Part A premium because they have enough work credits. Those without sufficient work history may pay $311 or $565 per month, depending on their credits.

Yes. The Medicare Part B annual deductible increased to $283 in 2026, up from $257 in 2025.

Yes. SSDI beneficiaries with higher incomes may pay more due to IRMAA (income-related monthly adjustment amounts), which are based on tax returns from two years prior.

Yes. Medicare Savings Programs and Extra Help may reduce or eliminate Medicare premiums and other out-of-pocket costs for eligible low-income SSDI beneficiaries.