Are you counting down the days until your disability check arrives, but not quite sure when the deposit will hit your account? If so, you are not alone. Knowing the exact deposit date is essential for planning rent, bills, and everyday expenses.

For millions of people receiving Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI), these benefits cover necessities such as housing, groceries, and medication. The challenge is that payment dates are not always simple and straightforward. They depend on whether you receive SSI, SSDI, or both, and they sometimes even shift because of weekends or federal holidays.

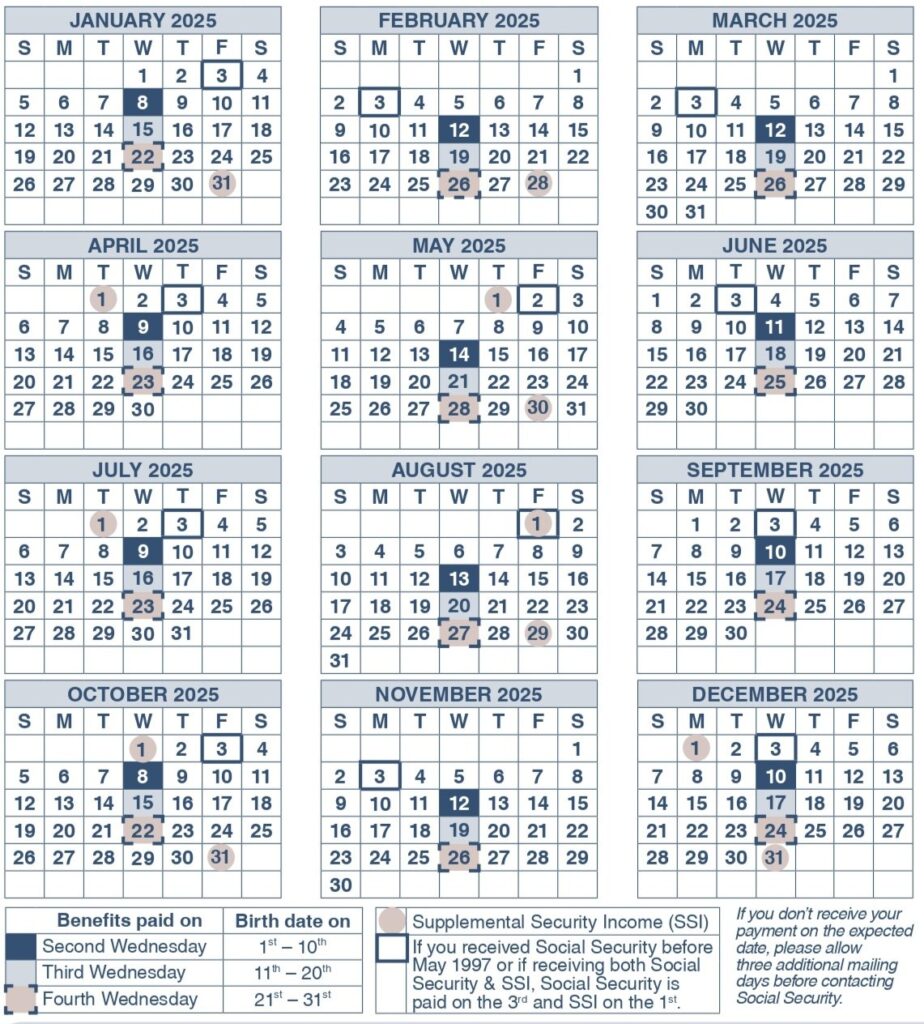

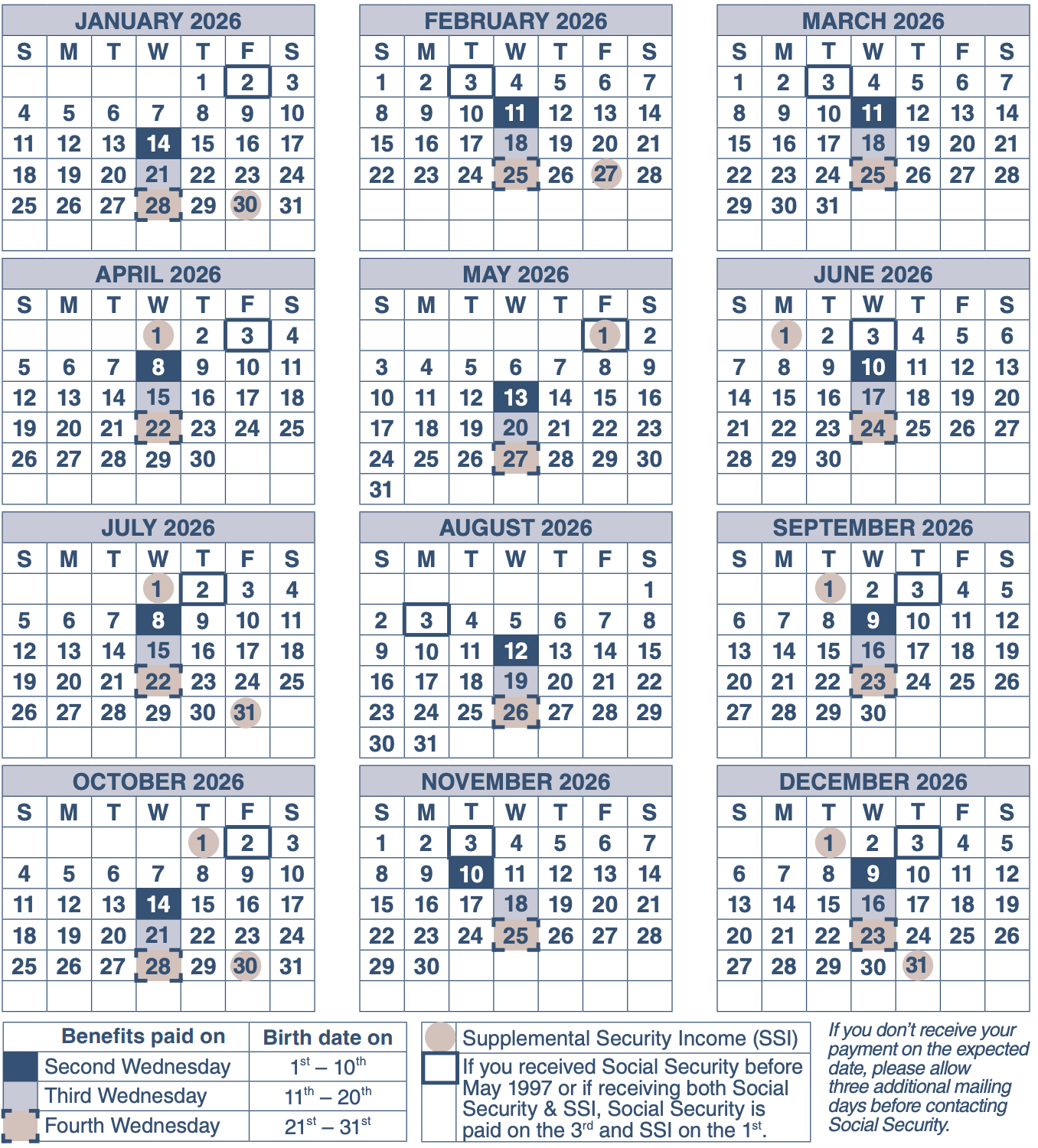

The good news? Once you understand how the Social Security Administration (SSA) sets its schedule, you will know exactly when to expect your money. Below, we break down the 2025 and 2026 payment calendars so you can plan with confidence.

Understanding Your Social Security Disability Payment Schedule

The timing of your payment depends on the type of benefit you receive, SSI or SSDI, and a few special exceptions. In general, SSDI payments are tied to your birthday, while SSI payments follow the consistent first-of-the-month rule.

Direct answers: When to expect your disability check

Here’s the short version:

- SSDI: Paid on Wednesdays, based on your birthday

- SSI: Paid on the first of the month

Exceptions: If your payment date falls on a weekend or federal holiday, payment moves to the prior business day.

You can always confirm your deposit day using SSA’s 2025 Benefits Payment Schedule.

The importance of knowing your specific payment type (SSI vs. SSDI)

Understanding whether you receive SSI or SSDI matters because each program follows a different calendar. Some people also receive both, which can create unique timing issues.

- SSI payments

- SSI is designed to help people with limited income and resources.

- Payments are typically made on the first of each month.

- If the first falls on a weekend or federal holiday, the deposit is usually sent the business day before.

- SSDI payments

- SSDI is based on your work history and the Social Security taxes you’ve paid.

- Payment dates are tied to the beneficiary’s birthday:

- 1st–10th: Paid on the second Wednesday of the month

- 11th–20th: Paid on the third Wednesday of the month

- 21st–31st: Paid on the fourth Wednesday of the month

- If you started receiving SSDI before May 1997, your payment generally comes on the third of each month, regardless of your birthday.

- Receiving both SSI and SSDI

- Some beneficiaries qualify for both programs. In these cases, you may see two separate deposits each month — one following the SSI schedule and the other following the SSDI schedule.This can sometimes cause confusion, especially if one payment comes early because of a holiday.

Knowing exactly which benefit(s) you receive will help you check the right calendar, avoid unnecessary worry if you see only one deposit arrive, and plan your budget with confidence.

Social Security Disability Insurance Payment Schedule

SSDI payments are based on your date of birth and are deposited on Wednesdays each month.

Here is the schedule of SSDI payments in 2025:

Special rules for those who began receiving benefits before May 1997

If you began receiving Social Security benefits before May 1997, your payments follow a different schedule than newer beneficiaries. Instead of being tied to your birthday, as with the modern SSDI system, your payments follow the “old payment system,” which is as follows:- Standard payment date

- Benefits are usually deposited on the third day of each month, no matter when your birthday falls.

- Weekend or holiday adjustment

- If the third day of the month falls on a Saturday, Sunday, or federal holiday, you’ll generally receive your payment on the business day before.

- For example, if July 3rd is a Sunday, your payment will usually arrive on Friday, July 1st.

- For all types of benefits

- This rule covers both retirement and disability beneficiaries who were already receiving payments before May 1997.

Impact of weekends and federal holidays on SSDI deposits

If your Wednesday falls on a holiday or weekend, the SSA moves the deposit to the business day before. For example, if your birthday puts you on the third Wednesday, but it lands on Christmas Day, your payment would arrive on Tuesday, December 24.What happens if you receive both SSDI and SSI benefits?

Some people qualify for both programs, a situation known as concurrent benefits. If this applies to you, it’s important to understand that SSI and SSDI follow different deposit schedules, which means your payments will not arrive together. Occasionally, if the SSI deposit is issued early due to a weekend or holiday, it may even look like you’ve received two deposits in the same calendar month, even though one is actually an early payment for the following month.Supplemental Security Income Payment Schedule

For most people receiving SSI, the payment schedule is very predictable: deposits are made on the first day of each month. Unlike SSDI, which follows a birthday-based schedule, SSI sticks to this simple monthly rule. That consistency is one of the program’s key advantages for budgeting.Adjustments for weekends and federal holidays

There’s one wrinkle in the SSI payment schedule: when the first day of the month falls on a Saturday, Sunday, or federal holiday. In those cases, the Social Security Administration issues your deposit on the business day before. For example:- If the June 1st falls on a Sunday, you’ll see your deposit on Friday, May 30th (two days early).

- If the September 1st is Labor Day, you’ll receive your deposit on August 30th or 31st, depending on the year.

When two payments arrive in one month

Every so often, you may notice that two SSI payments hit your account in the same calendar month. This doesn’t mean you’re being overpaid; rather, it happens because of how the schedule works. Here’s why:- If the first day of the following month falls on a weekend or holiday, the SSA sends that payment early, at the end of the current month.

- As a result, you receive your regular SSI payment on the first day of the month, plus an early payment for the next month, a few days before the current month ends.

How Disability Payments Are Delivered: Direct Deposit Is Key

Federal law requires nearly all benefit payments to be made electronically under 31 U.S.C. § 3332. Most people receive their benefits via direct deposit or the Direct Express® Debit Mastercard®. The reason for this is simple: electronic payments are safer, faster, and less expensive than mailing paper checks.The efficiency and reliability of direct deposit

Direct deposit is the fastest and most reliable way to receive your disability benefits. Instead of waiting for a paper check in the mail, which can be delayed due to weather or postal service issues — or could even be lost mail — your funds are deposited directly into your bank account on your scheduled payment date. The benefits of using direct deposit include:- On-time delivery: Payments arrive the morning of your scheduled date.

- Security: There’s no risk of checks being stolen or misplaced.

- Convenience: You get immediate access to your money without needing to visit the bank to deposit a check.

Using the Direct Express Debit Mastercard as an alternative

If you don’t have a checking or savings account, you can still receive your disability payments securely through the SSA’s Direct Express card program. This is a prepaid debit card option offered by the US Treasury and the SSA. The debit card’s key features include:- Automatic deposit of your benefits onto the card each month

- Widely accepted wherever Mastercard is used, including ATMs, grocery stores, and online shopping

- No need for a bank account, making it an accessible option for those who prefer not to use traditional banking

- FDIC protection, which helps keep your funds safe

Are paper checks still allowed?

Rarely, but waivers exist for people who:- Cannot open a bank account

- Have certain mental or medical conditions

- Face legal or technical barriers

New updates for 2025

In March 2025, the White House issued an executive order directing all federal payments to move to electronic methods by September 30, 2025, wherever the law allows. Paper checks will become even less common, though the waiver process will remain available.What to Do If Your Disability Payment Is Delayed or Missing

Delays can happen, but knowing the right steps helps you resolve them quickly.Common reasons for a payment delay

Some of the most common reasons your payment might be delayed include:- Processing errors: Occasionally, the SSA’s systems experience technical glitches or delays in processing payments. These are usually temporary and resolved quickly, but they can push your deposit back by a day or two.

- Bank holds: Even if the SSA releases your funds on time, your bank may place a short hold on the deposit before making it available to you. This is especially common if you’ve recently changed accounts or if the deposit is flagged for review by the bank’s fraud prevention systems.

- Outdated deposit information: If you’ve recently switched banks or closed an account but haven’t updated your direct deposit details with the SSA, your payment may be sent to the wrong place. In these cases, the funds are typically returned to the SSA, and reissuing the payment can take additional time.

- Overpayment adjustments: If the SSA determines that you were previously overpaid, they may reduce or withhold part of your current month’s benefit to recover the excess. This can make it look like a delay or missing payment when, in fact, it’s an adjustment.

- Pending SSA verifications: Sometimes, payments are paused while the SSA verifies eligibility, income, or other details. This can happen if you’ve reported a life change (such as work, marriage, or income updates) or if SSA is conducting a routine review of your case.

- Administrative errors: A clerical error, incorrect coding, or missing documentation can all result in a delayed deposit. Resolving these issues typically require contacting the SSA directly.

Steps to take when your payment doesn’t arrive on time

Payment delays can be stressful, but these steps can help you understand what’s going on and what to do next.- Check your bank account.

- Confirm your direct deposit information.

- Log in to your mySocialSecurity account.

- If your payment hasn’t arrived within a few business days and everything looks correct, call the SSA at 1-800-772-1213.

Avoiding future payment issues

Take these proactive steps to ensure your disability benefits arrive on time each month.- Keep your bank and contact info up to date: If you switch banks, open a new account, move to a new address, or change phone numbers, make sure to notify the SSA as soon as possible. Outdated records are one of the most common causes of missed or delayed payments.

- Enroll in direct deposit: Direct deposit is the safest and most reliable way to receive your benefits. It eliminates mailing delays, reduces the risk of lost or stolen checks, and ensures your funds are available on your payment date.

- Watch for letters or notices from the SSA closely: The SSA may send you notices about your eligibility, payment adjustments, or required actions. Ignoring or missing these communications can lead to interrupted payments. Always read SSA letters carefully and respond by the deadline if action is needed.

Staying Informed About Your Disability Benefits and Payment Dates

The best way to avoid surprises is to stay up to date with SSA’s resources and create your my Social Security account. You can log in your account to view your payment history, see upcoming deposit dates, and download and annual SSA payment calendar. You can also subscribe to SSA updates to stay informed about any changes in payment schedules. In particular, the SSA offers newsletters and email alerts. You can sign up through your my Social Security account or visit the SSA website to manage your subscription preferences. You can also bookmark the SSA Payment Schedule page so you always know your next pay date.Understanding Cost-of-Living Adjustments (COLA) and Other Factors Affecting Benefit Amounts (Not Deposit Day)

Cost-of-living adjustments (COLA) affect the amount of your check, not the date it arrives. Each year, the SSA may increase benefits to keep up with inflation and rising living costs. This ensures your buying power isn’t eroded over time. For example, if the COLA is 3%, your monthly benefit will rise by that percentage starting in January of the new year. For updates, check SSA announcements, or see our blog post on the 2025 COLA increase. Knowing when your disability check will arrive each month takes the guesswork out of your finances. By understanding whether you receive SSI, SSDI, or both, and staying aware of the official SSA payment schedule, you will be better prepared to plan your budget. If you need more help understanding your benefits, contact your local SSA office or visit our blog resources on Social Security disability topics. You can also call LaPorte Law Firm to speak with an experienced disability attorney who can guide you through your specific situation.FAQS

SSDI is deposited on Wednesdays. Payments are based on the recipient’s birthday. Meanwhile, SSI is deposited on the first day of the month.

If your disability payment falls on a weekend or a federal holiday, you will receive it on the business day before.

The RFC is a critical piece of evidence used to determine if you can work. A well-supported RFC can tipYes. If you qualify for both programs, you will receive two separate payments, your SSI on the first day of the month and your SSDI on its scheduled Wednesday. the balance in your favor.

To check on the status of your disability payment, you can log in to your my Social Security account or call the SSA at 1-800-772-1213.

If your payment doesn’t arrive on time, first check with your bank, make sure your direct deposit information is correct, and then contact the SSA if the issue still isn’t resolved within a few business days.